Have you ever felt like the market moves against you right after the opening bell, leaving you scratching your head? Many traders experience this, especially when big players seem to control the early action. Understanding what happens around 9:30 AM, when the market first wakes up, can make a real difference in your trading.

This article explores a well-known concept, often called the "Po3" idea, that helps explain these early market movements. It’s a way to look at how large institutions, sometimes called 'smart money,' shape prices, especially during those first moments of the trading day. We'll look at its stages and how it applies to what you see on your charts.

By learning about this three-part approach, you might start to see market action in a new way. It offers a framework for spotting the methods big banks use to get positions and, in a way, direct where prices go. So, if you're keen to grasp more about market structure and how institutional players influence things, this discussion is for you.

Table of Contents

What is the Three-Phase Market Model (Po3)?

The Three Core Stages: Accumulation, Manipulation, and Distribution

Accumulation: Building Positions Quietly

Manipulation: The Smart Money's Play

Distribution: Taking Profits and Reversing Course

Why 9:30 Market Open is a Key Time for Po3

Spotting the Three-Phase Model in Action

Is the Three-Phase Model for Everyone?

Frequently Asked Questions About Po3

What is the Three-Phase Market Model (Po3)?

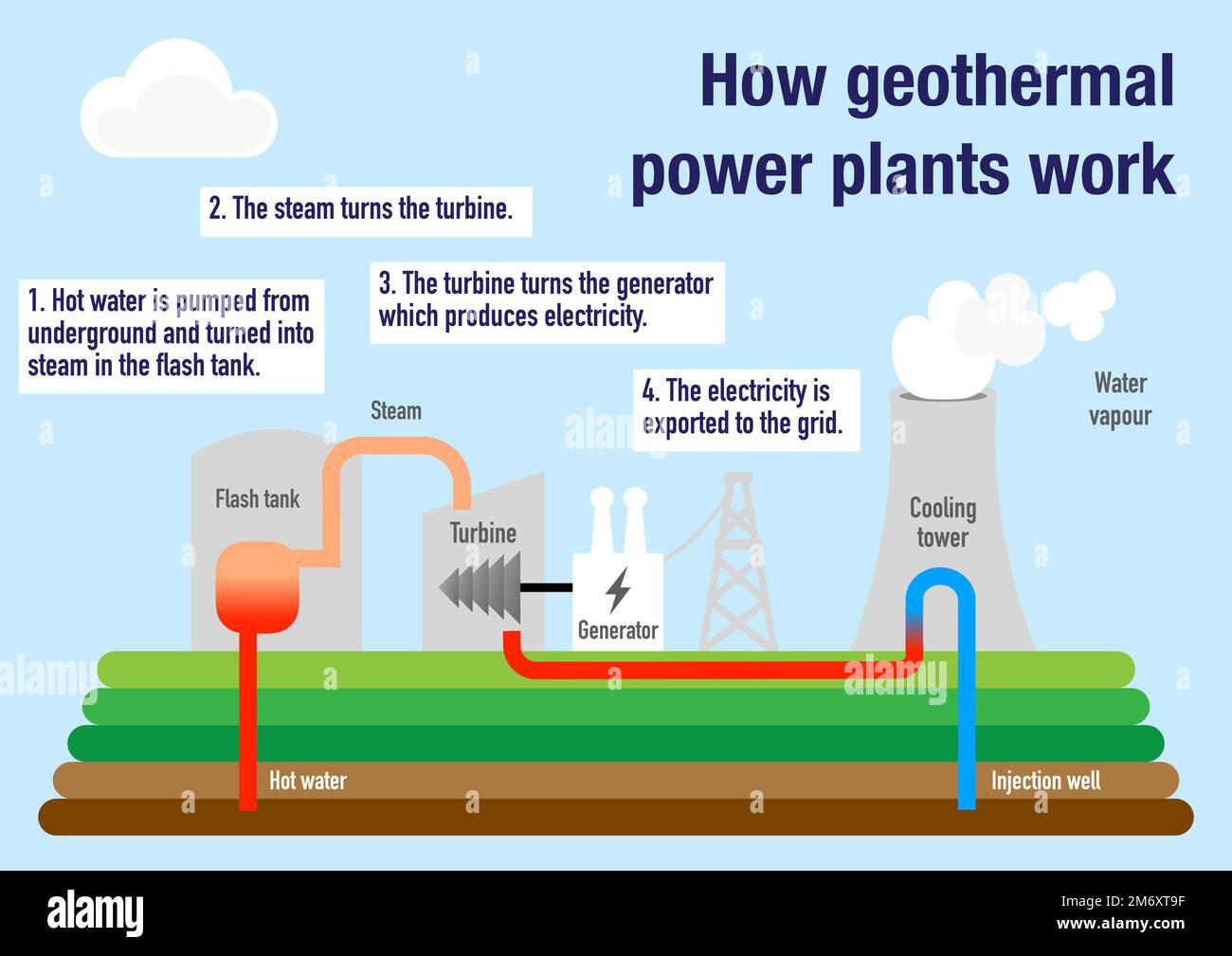

The ICT three-phase model, or Po3, is a rather advanced idea that asks for a good grasp of how markets are built and how technical analysis works. It's a way of looking at how candles or bars form on your chart, which, you know, is important for any timeframe. This model, often used within the larger daily and weekly market swings, really shines when considering the opening moments of the trading day. It’s, in a way, a strategic trading method that helps traders spot what 'smart money' is doing. It breaks down market movements into three clear stages, which we will discuss in more detail, you know.

This approach was, actually, put together by ICT to help everyday traders figure out the moves made by big institutions in the market. It centers on three main parts of a price move: accumulation, manipulation, and distribution. The Po3 idea is built on the idea that markets move in cycles and shows how market makers, those big financial groups, set up situations to catch retail traders and gather up liquidity. It’s about getting a deeper look at how large banks operate and, so, make significant profits. This concept is, quite literally, crucial for successful intraday trading, as it gives you a framework for understanding daily price moves and finding setups within the day, especially in areas like forex, indices, and crypto.

The core idea behind the Po3 concept is to mimic the actions of large institutions, those entities with the ability to move markets. They operate with clear strategies, shaping price action to their advantage. This model, in essence, helps you see the market through their eyes, so to speak. It’s a distinctive approach that aims to shield traders from falling into smart money traps. By analyzing these market phases, traders can identify patterns in price movements and, you know, make informed trading decisions that are more in line with the true market flow. It’s a very practical framework for understanding market behavior.

The Three Core Stages: Accumulation, Manipulation, and Distribution

The three-phase model, sometimes called AMD, helps everyday traders see what the big financial players are doing. It’s, in some respects, a distinctive way to look at trading, especially in forex, because it focuses on three important parts of how the market moves. Understanding these parts can help shield traders from falling into those clever traps set by smart money. By looking closely at these market phases, traders can, you know, find patterns in how prices move and make more informed trading decisions. This whole idea tries to, basically, copy what smart money traders or big institutions do.

Accumulation: Building Positions Quietly

The first stage is accumulation. During this period, prices tend to stay in a fairly tight range, more or less consolidating. This is when the larger market players are, quietly, building up their positions. They are buying or selling without making a big splash, preparing for a larger move later. You might see a flat market, or one with small ups and downs, as these institutions gather their preferred assets. It's, typically, a time of relatively low volatility, as they don't want to alert other market participants to their intentions. Think of it as the calm before the storm, so to speak.

During accumulation, institutions are, essentially, gathering enough assets to make a significant impact on the market later. They do this by placing orders in a way that doesn't cause a sudden price jump or drop. This often involves using various order types and spreading their purchases or sales over a period of time. So, you